11 de Enero del 2021

* Información extraída y adaptada del portal de la Cámara de Comercio de Estados Unidos

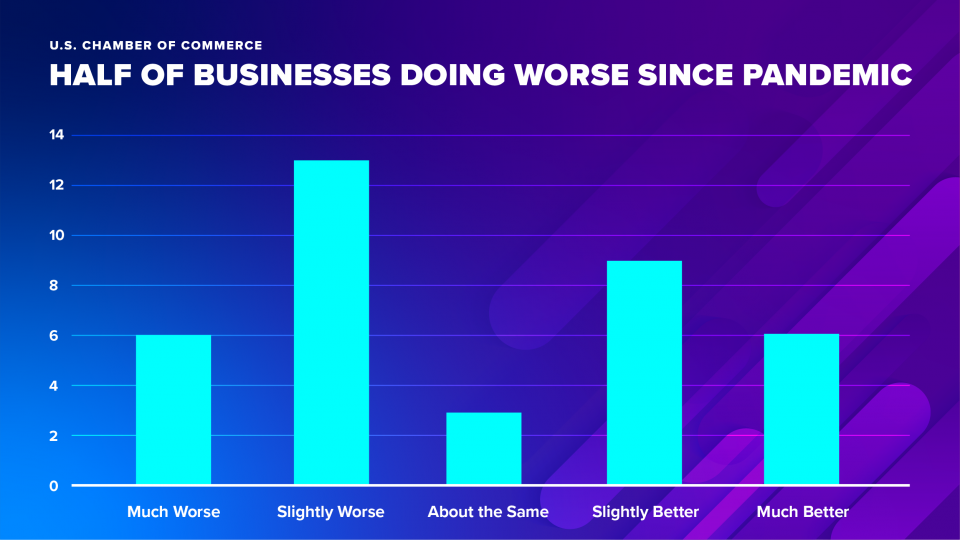

Thirty-seven business leaders, ranging from healthcare to finance and energy to entertainment, shared where their industries are on the K-shaped recovery. Of the 37 responses, 19 (51%) say they are doing slightly or much worse than pre-pandemic, 15 (41%) slightly or much better, and three (8%) the same.

“Ten months after COVID-19 caused an unprecedented disruption in economic activity, some industries have fully recovered while others are in the equivalent of a depression,” said Neil Bradley, Executive Vice President and Chief Policy Officer, U.S. Chamber of Commerce. “The full reopening of the economy that widespread vaccinations will make possible offers a light at the end of the tunnel, but we will be dealing with the fallout from the pandemic for years to come. As we rally for recovery, it is critical that policymakers pursue pro-growth policies that can help business, families, and communities fully recover.”

These findings will be explored during the Chamber’s annual State of American Business program.

Fuente: US Chamber of Commerce

- Airports: At least $23 billion loss expected from March 2020 to March 2021 for the U.S. airport industry.

- Construction: Although residential and infrastructure construction were strong in 2020, data indicates that construction spending for office, industrial, warehouse, and retail buildings was down 29.8% from 2019.

- Energy: After the initial COVID-19 shock, total U.S. petroleum demand returned to 19.1 million barrels per day and the five-year range by November 2020.

- Finance: During the second quarter, credit union deposits grew 15 times faster than they did during the same period one year prior.

- Food Retail: Consumer spending was up 25% from February to March. Most food retailers (61%) said strong demand had positive impacts on their businesses even if the new dynamics stretched their capabilities like never before.

- Gaming: The closure of all 989 U.S. casino properties impacted more than one million American gaming and small business employees and caused a total economic loss of $43.5 billion.

- Hospitality: 63% of hotels have less than half of their typical pre-crisis staff working full-time today.

- Housing: Projections show up to $70 billion in rental debt by the end of 2020.

Small businesses, which span all industries and regions, report a similar split and K-shaped recovery. According to the most recent MetLife & U.S. Chamber of Commerce Small Business Index, 48% of small businesses say their businesses’ health is average or poor and 50% of small businesses say their business is in good overall health. However, 80% or more of small businesses are concerned about the virus’s impact on America’s economy.