16 de Marzo del 2022

* Información extraída directamente del portal de la Cámara de Comercio de EE.UU. (02/03/2022)

‘Small businesses everywhere are being impacted by the interrelated challenges of rising inflation, supply chain disruptions, and the worker shortage crisis—but inflation is hitting small businesses especially hard.

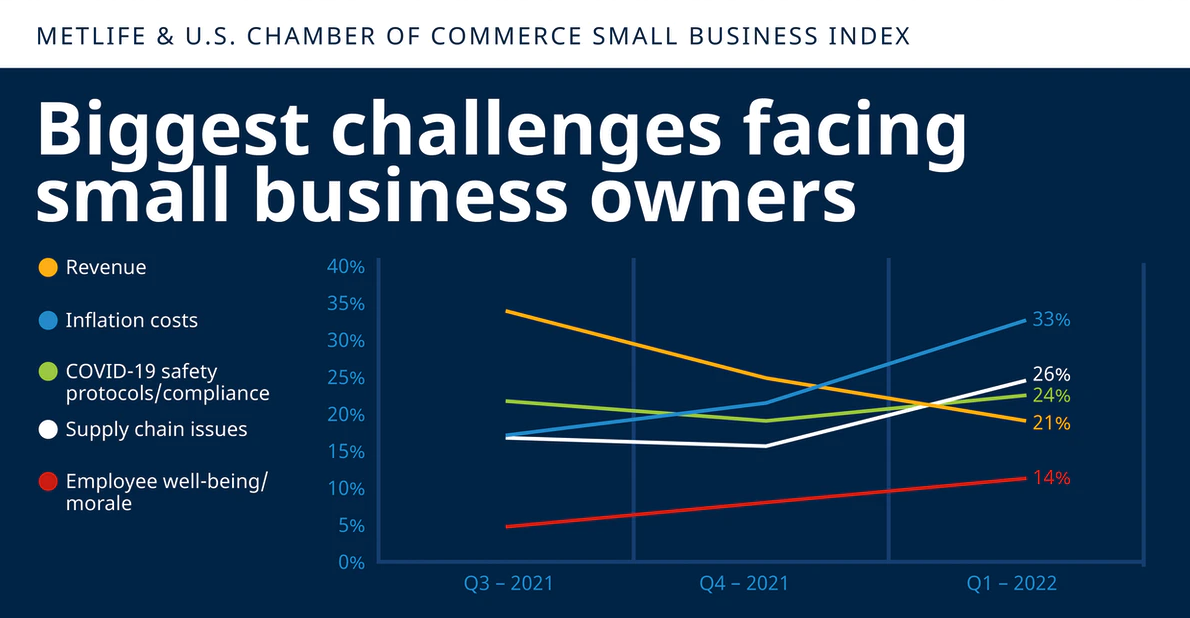

Inflation is, by far, the top concern for small businesses this quarter, according to new data from the MetLife & U.S. Chamber of Commerce Special Report on Inflation and Supply Chain Shocks on Small Business. While these were key challenges cited last quarter, concerns around inflation and supply chains have intensified quickly.

Fuente: US Chamber

One in three (33%) small businesses now rank inflation as the biggest challenge facing the small business community (up 10 percentage points from Q4 2021) and up 14 percentage points from Q3 of last year. Additionally, according to the survey taken January 14 – 26, 2022, 85% of small business owners say they are concerned about the impact of inflation on their business, soaring from 74% last quarter.

Last week, data on the Federal Reserve’s preferred measure of inflation (PCE inflation) was released and showed prices rose more than 6% over the past year. This was the highest level since February 1982.

To cope with inflation, 67% of small businesses have raised prices. Another four in ten (41%) report having decreased staff or taken out a loan in the past year (39%) in response to growing inflation pressures.

“Having survived the pandemic, now small business owners are being hit with surging inflation. It’s limiting their purchasing power and forcing small businesses to raise their own prices and absorb higher costs within already thin margins,” said Neil Bradley, executive vice president and chief policy officer at the U.S. Chamber of Commerce. “We need policymakers to pursue policies that will reduce inflationary pressures, including addressing the worker shortage crisis, expanding trade, and reducing tariffs.”

The survey also shows that inflation is everywhere: the impacts of rising inflation are affecting small businesses of every size, in every sector, and in every region of the country. Across sectors, those in the manufacturing (41%), services (35%), retail (32%) and professional services (29%) sector all cite inflation as one of the top challenges facing the small business community.

Businesses Not Root Cause of Inflation

In a recent blog post, Curtis Dubay, senior economist at the U.S Chamber of Commerce, made clear that businesses raising their prices is not a root cause of inflation. Rather, businesses are responding to greater market forces—like supply and demand, the worker shortage, and monetary policy—instead of generating inflation themselves.

“Businesses raise prices when input prices rise. Both the prices of materials and labor are rising rapidly because of shortages and strong demand. Businesses can either see their margins shrink and start losing money, or they can raise prices to offset those higher costs,” Dubay said.

According to Dubay, high inflation is likely to remain with us for some time and will come down through the middle of the year as supply chain problems ease, more workers come back to the labor force, and monetary policy adjusts.

Raising Rates Growing Concern for Some Small Businesses

Some small businesses also cited concern about rising interest rates this year—and what impact that might have on their business.

As the Federal Reserve prepares for its March meeting where it is anticipated they will raise interest rates, seven in ten (70%) small businesses are concerned about the impact rising interest rates will have on their business.

In fact, nearly three in ten (29%) are very concerned about rising interest rates. However, when prioritizing the top challenges the small business community faces, business owners rank rising interest rates at the bottom of concerns coming out of the pandemic (only 7% said rising rates are a big challenge).’